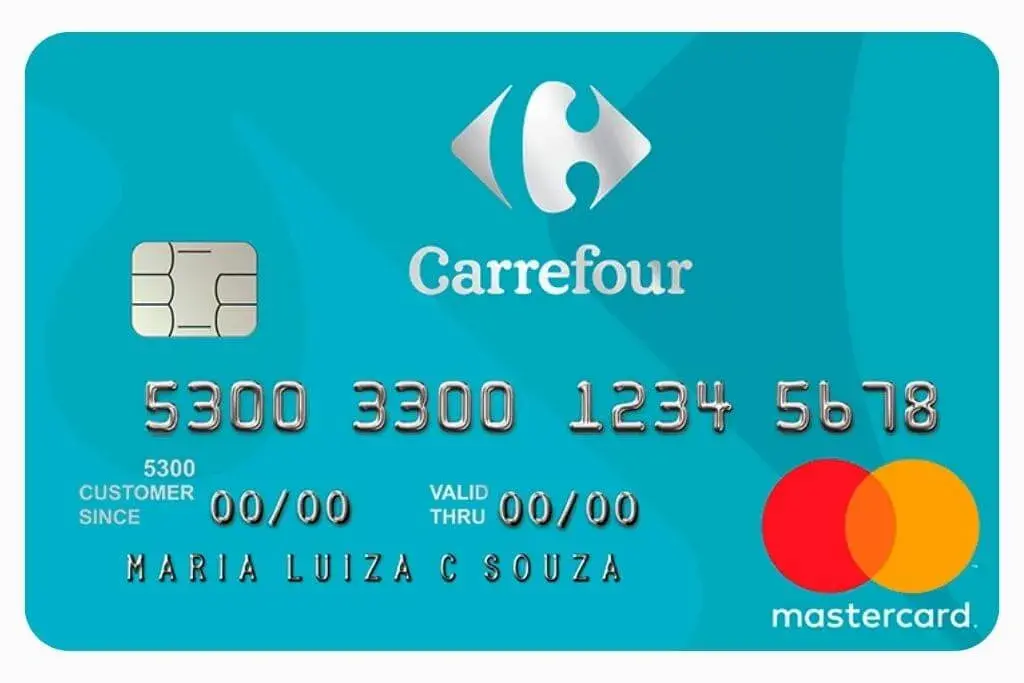

Discover all the advantages of the Carrefour Card and how it can be your ally in everyday shopping.

Adverts

The Carrefour Card is one of the most popular credit cards for consumers who want exclusive benefits when shopping at Carrefour and partner establishments.

Specially designed to facilitate access to products with more competitive prices and special conditions, the Carrefour Card has been gaining popularity among those who frequently shop at the chain and are looking for a practical and economical financial solution.

As well as exclusive benefits within Carrefour shops, the card offers advantages such as reduced annual fees, exclusive discounts, differentiated instalment conditions and the possibility of using it in other commercial establishments.

Adverts

In this article, we'll explore all the features and advantages of the Carrefour Cardfrom how it works to how to request it and use it strategically.

Quick Index:

What is the Carrefour Card?

The Carrefour Card is a credit card offered by Carrefour Soluções Financeiras, the financial arm of the Carrefour chain in Brazil.

This card is aimed at consumers who want advantages for their purchases within the Carrefour network, as well as the convenience of a credit card that can be used in various other establishments.

It is available under the Mastercard and Visa flags, which guarantees wide acceptance in national and international shops, as well as offering exclusive advantages for the chain's customers.

With the Carrefour Card, the user can obtain discounts on specific products, special payment conditions, annual fee exemption for those who make monthly purchases at Carrefour, as well as loyalty programmes and benefits offered by the brand.

How does the Carrefour Card work?

The Carrefour Card works like a conventional credit card, allowing customers to make purchases in cash or in instalments, with payment of the bill in the following month.

It also offers exclusive conditions for purchases in Carrefour shops, such as differentiated instalments and exclusive discounts on specific products.

When making a purchase in Carrefour shops, customers have access to exclusive conditions, such as up to 24 interest-free instalments on household appliances and additional discounts on selected products.

One of the advantages is the possibility of waiving the annual fee, as long as the customer makes at least one purchase a month in Carrefour shops or on its e-commerce site. For those looking for an economical and advantageous alternative, the Carrefour Card can be an interesting choice.

General Features

| Features | Description |

|---|---|

| Card Name | Carrefour Card |

| Flag | Mastercard and Visa |

| Issuing Bank | Carrefour Financial Solutions |

| Annuity | Can be exempted with a monthly purchase in Carrefour shops |

| Cover | National and international |

| Existing models | Physical and virtual card |

| Limit | Variable, according to credit analysis |

| Points Programme | Points and exclusive offers on Carrefour products |

| Cashback programme | No cashback programme |

| Payment instalments | Exclusive instalments up to 24x on Carrefour products |

| Name of the Management App | Meu Carrefour (available for iOS and Android) |

Advantages

Exclusive discounts at CarrefourCarrefour Card holders have access to exclusive offers on selected products from the Carrefour network, allowing them to make significant savings on everyday purchases, especially food, household appliances and hygiene products.

Differentiated instalment planFor specific products, such as household appliances and electronics, you can pay in instalments up to 24 times without interest, something that few credit cards offer.

Zero Annuity with Condition: One of the advantages of the Carrefour Card is the possibility of waiving the annual fee. To secure this advantage, customers just need to make at least one purchase a month in Carrefour shops or on the chain's e-commerce site.

International acceptanceWith the Mastercard and Visa flags, the Carrefour Card is widely accepted in Brazil and abroad, allowing customers to use it for all their needs, whether for local or international purchases.

App for complete managementThrough the "Meu Carrefour" app, customers can monitor their spending, check their limits, access invoices, make bill payments and even block their card temporarily if necessary.

Mastercard/Visa Offers and BenefitsIn addition to Carrefour's own benefits, customers can also take part in the Mastercard and Visa benefits programmes, such as the Mastercard Surpreenda and Go with VisaThese offer promotions and advantages at various partner establishments.

Disadvantages

No cashbackFor consumers looking for a direct financial return, the Carrefour Card may not be the best option, as it does not offer a cashback programme.

Carrefour Conditional BenefitsAlthough the card is accepted in other establishments, its greatest advantages and discounts are concentrated in the Carrefour chain, which may limit the use of the card for those who don't regularly frequent this chain.

Possibility of AnnuityIf the customer does not make a monthly purchase in Carrefour shops, an annual fee will be charged, which may be a negative point for some users.

How to apply for your Carrefour Card

Applying for a Carrefour Card is a simple, digital process. See how to apply:

- Visit the Carrefour Solutions website: On the website Carrefour SolutionsThen the customer can start ordering the card.

- Fill in the Application FormOn the website, fill in the personal and financial details requested so that a credit analysis can be carried out.

- Choose the FlagCustomers can choose between Visa and Mastercard, depending on their preference.

- Wait for ApprovalAfter credit analysis, the customer will be informed of approval and the initial limit. If approved, the card will be sent to the address registered.

- App Activation and ManagementAfter receiving the card, the customer must activate it through the "Meu Carrefour" app and will be able to manage all the functionalities, such as checking the limit and invoice, directly through the app.

*You will be redirected to another site.

Exclusive Benefits

The Carrefour Card offers some exclusive benefits for customers who make purchases on the network, and stands out for its special conditions and ease of use:

Zero annual feeBy making one purchase per month at any Carrefour shop, the customer is exempt from the annual fee.

Exclusive instalmentsAllows you to pay in instalments for selected products up to 24 times without interest, both in physical shops and on the Carrefour website.

More time to pay: Offers a longer payment period for fuel at all Carrefour petrol stations.

Exclusive DiscountsExclusive benefits on selected products bought in Carrefour shops or on the website.

10x without interest at Carrefour Drugstores: You can pay in instalments for medicines and beauty products up to 10 times without interest at Carrefour drugstores.

Exclusive Partnerships: Exclusive discounts at partner companies when using the Carrefour Card.

Benefits at Atacadão and Sam's Club StoresCarrefour Card customers have access to exclusive benefits at the Atacadão and Sam's Club chains, expanding their shopping options.

Final considerations

The Carrefour Card is an excellent option for frequent consumers of the chain, especially because of the exclusive discounts, instalment conditions and the possibility of waiving the annual fee.

It offers attractive benefits for those who make recurring purchases at Carrefour, as well as the practicality of the "Meu Carrefour" app, which allows for more agile and practical financial management.

For consumers looking for general benefits such as cashback or more comprehensive points programmes, the Carrefour Card may not be the best option, since its main benefits are focused on purchases from the chain itself.

In short, it's an advantageous card for those who want to save money on their day-to-day and supermarket shopping, as long as they take advantage of the benefits offered by the chain.

Will Bank Card: how to apply

Find out how to apply for this card and take advantage of all its features and benefits!

Continue reading →Frequently Asked Questions

Does the Carrefour Card have an annual fee?

Yes, but the annual fee can be waived. Customers just need to make at least one purchase a month in Carrefour shops or on the e-commerce site.

Where can I use the Card?

The Carrefour Card is accepted at national and international establishments, as it is issued under the Mastercard and Visa flags.

Does the Carrefour Card offer cashback?

No, the Carrefour Card does not currently have a cashback programme.

How do I apply for a Carrefour Card?

Applications can be made via the website Carrefour Solutionsfilling in a form and analysing credit.

Does the Carrefour Card have a points programme?

It doesn't have a points programme, but it does offer discounts and exclusive conditions for purchases in Carrefour shops.

Can I manage my Carrefour Card via the app?

Yes, the "My Carrefour" app allows customers to monitor their limits, consult invoices and take advantage of special offers.

Is the Carrefour card international?

Yes, the Carrefour Card has international coverage and can be used for purchases abroad.